S&P 500 ROAD-MAP Elliott Wave Analysis

Starting from the Year 1877

Contents:

1. 1st Wave (Y 1877 – 1929)

2. 2nd Wave (Y 1929 – 1932)

3. 3rd Wave

(Y 1932 – Under Progress.

4. Forecast of Sub-Wave 4th

S&P500 Index

Today

is 31st Jan 2023 and I am counting the waves of

the S&P500 Index. Let’s start the journey.

Ist

wave: Started from a Significant Low of $2.66 in Y 1877.

We can see five

sub-waves in green color and End at $30 in Y 1929 Around

52 Years have taken to develop the 1st wave.

II Wave : It is Y1929 to $1932 and Price $30 to $4.71 II wave was deep and sharp, with around 94% retracement of 1st wave and

only 3 years taken to complete. You can imagine which type of panic was created

in 1929-1932.

III Wave: It is $4.71 to continue...and Y 1932 to ??? Is

it 100 Years Cycle?

Sub-wave

1: Y 1932 to Y 2000

& Price $4.71 to $1550 We can see five green color mini sub-waves inside

the 1st sub-wave. A total of 68 years have taken to complete the 1st

sub-wave.

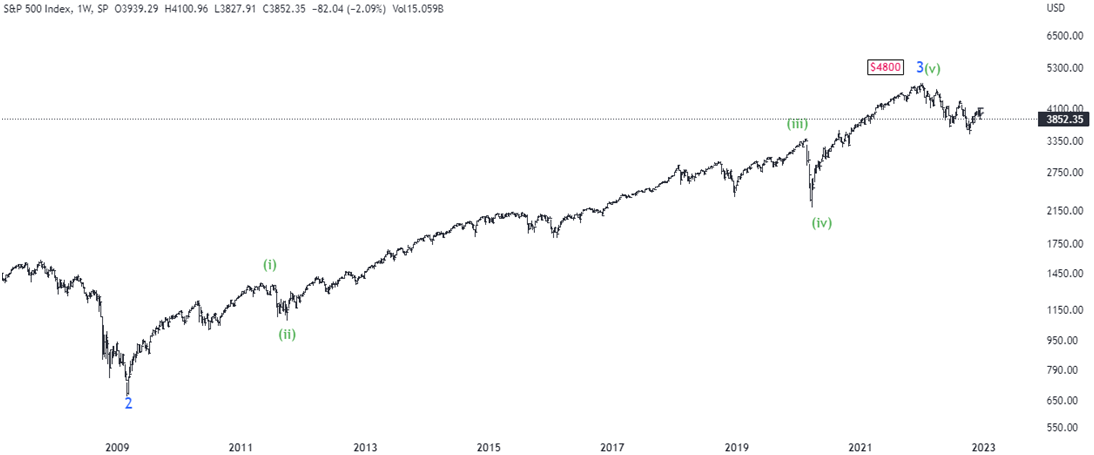

Sub-wave

2: Y 2000 to Y 2009 (

Total 9 Years) Price $1550 to $666It

has shown flat correction as abc in which “b” wave tends to go up to the

start of “a” wave.

We

can see in chart 2nd sub-wave correction exactly ends between

Fibonacci 50% to 61.8%

As

per the rules of alternation 2nd sub-wave was simple and deep, we

may see 4th sub-wave as complex and shallow. This is a very

important thing to forecast the 4th sub-wave. We will discuss this

later when we will analyze 4th sub-wave.

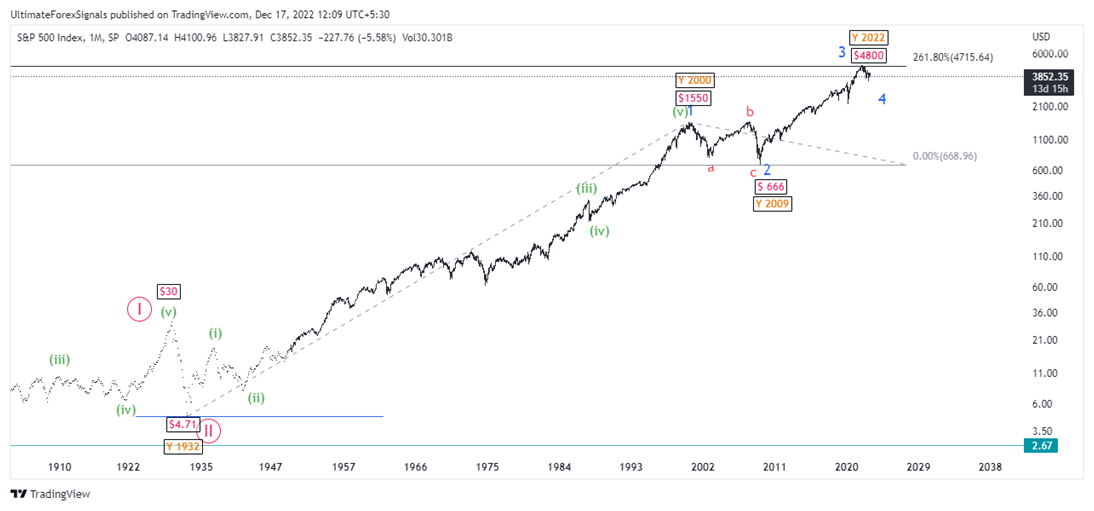

Sub-wave

3: Y 2009 to Y 2022 (

Total 13 Years) Price $666 to $4800 As

usual 3rd wave personality is easily identified on

the chart in any degree. Here extended Sub-wave 3 is exactly 261.8%

Fibonacci ratio of 1st sub-wave.

As

usual 3rd wave personality is easily identified on

the chart in any degree. Here extended Sub-wave 3 is exactly 261.8%

Fibonacci ratio of 1st sub-wave.

As

usual 3rd wave personality is easily identified on

the chart in any degree. Here extended Sub-wave 3 is exactly 261.8%

Fibonacci ratio of 1st sub-wave.

As

usual 3rd wave personality is easily identified on

the chart in any degree. Here extended Sub-wave 3 is exactly 261.8%

Fibonacci ratio of 1st sub-wave.  Inside

Sub-wave 3, Mini sub waves as mentioned in green color also dance to Elliott

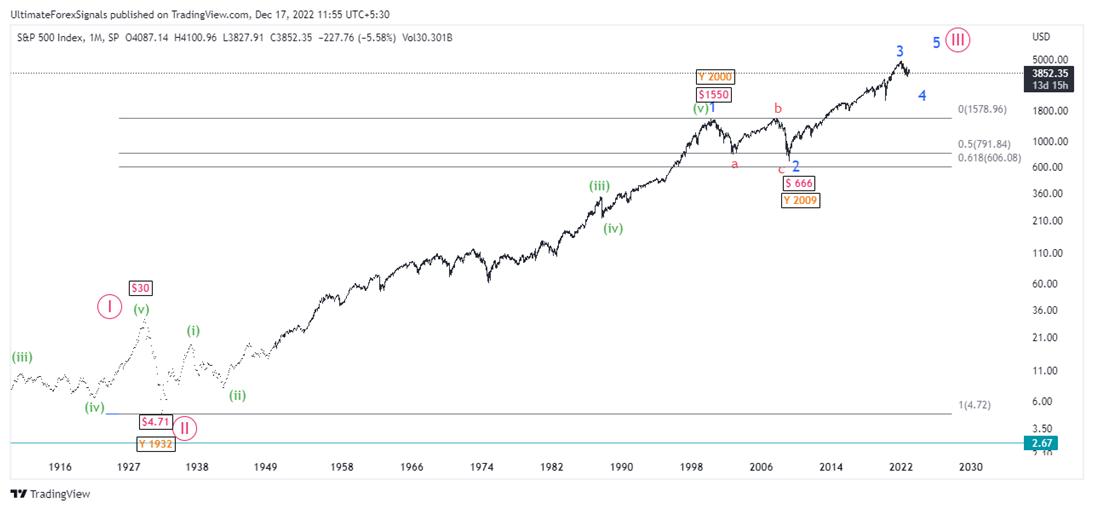

tunes.Sub-wave 4: Y 2022 to Under Progress & Price $4800 to .... ???

Inside

Sub-wave 3, Mini sub waves as mentioned in green color also dance to Elliott

tunes.Sub-wave 4: Y 2022 to Under Progress & Price $4800 to .... ???As Human beings, we love to predict the future

& Trading is a game where everyone wants to try their luck but few of them

succeed.

Why do they fail? The answer is none of them have a broad view of

Price sentiment. You should have one complete Road map for Entry &

Exit.

Let’s forecast Sub-wave 4,

Earlier we discussed the rules of an alternation. As 2nd Subwave

was flat and deep so 4th subwave may be shallow and Sharp.

WXY Double Zig-Zag Sharp Correction is unfolding and we know

it may be shallow. So we have a clue that we are in sharp and shallow

correction.

What do you mean by shallow correction ?? hmm right question.

Most of the time Shallow correction near Fibonacci 38.2% of the Prior wave.

Here 4th wave maybe 38.2% (Prior to the 3rd wave).

Let’s check the level. So

we have one level where the end of Sub-wave 4th correction is

$3230Let’s

double-check with the inside of the Sub-wave 4th pattern.

So

we have one level where the end of Sub-wave 4th correction is

$3230Let’s

double-check with the inside of the Sub-wave 4th pattern. WXY pattern is showing on chart.

WXY pattern is showing on chart.

From 3478 new impulse or X wave is begun.

If "X" wave then S&P500 may face resistance between 4300-4400 and one more down leg may appear in 2023.If new impulse then it will break the 4300-4400 and we may see new High.

Wait and watch for the next dance step of S&P500 ....

Thank You ...

So

we have one level where the end of Sub-wave 4th correction is

$3230Let’s

double-check with the inside of the Sub-wave 4th pattern.

So

we have one level where the end of Sub-wave 4th correction is

$3230Let’s

double-check with the inside of the Sub-wave 4th pattern. WXY pattern is showing on chart.

WXY pattern is showing on chart.

No comments:

Post a Comment