XAU/USD Elliottwave Analysis

Starting from Year 1833

Gold is the oldest currency on the planet. The attraction

of human beings toward gold has been going on for many years. Gold never lacks

trading volume because small investors, retailers, jewelers, hedge funds, and

big banks all trade in this pair. Let’s start the analysis.

Today's date is 29th Jan 2023. Let’s start a

detailed analysis from the Year 1833 low around $20

Y 1833 to Y1930

around this 100 Years price is moves $20 to $21 then sudden sharp move in

between 1930 to 1933 & Price touched to $34.

3rd

wave in any degree is always steep and you can easily identify. So here one

thing is clear that 1930 to 1933 is a 3rd wave.

Again price

range is bound from Y 1933 to Y 1968. Around 65 years price is around $35. Now

you can imagine those who invested in gold from 1933 to 1966 are how

frustrating years for them. It is definitely 4th wave as a frustrated wave

personality.4th wave is most the time-consuming wave to any degree.Elliott

has said one of the three impulses is extended.

Y 1968 to 1979

is extended 5th wave.

Price $35 to

$890

Wow!! what an investment

return in 10 Years.

Now I think you

are clever enough to understand the importance of Technical analysis in

investment also. You can save your time and time is money.

So here Y 1833

to 1978, Five impulse waves were completed & presented on the chart as

Green sub-waves as (i), (ii), (iii), (iv), (v)

These five

sub-waves are called the higher degree 1st wave & I label it on the chart

as wave (1 ).

So

our first higher degree wave (1) from Y 1833 to Y1979 around 146 years &

Price $ 20 to $ 890.

After

five impulses there is a time for correction as in Elliott’s basic 8-wave

pattern.

Now, it is time for ABC Correction.Before

starting ABC correction we understand about Zig-Zag Correction. Zig-Zag is a

5-3-5 Pattern as below.

In this

pattern, A & C wave has five waves & B wave has three waves or triangle.

C wave has always five waves in any correction. In a Zig-Zag correction “B” wave tends to be well below starting of the A

wave or below 61.8% of A wave.

In this

pattern, A & C wave has five waves & B wave has three waves or triangle.

C wave has always five waves in any correction. In a Zig-Zag correction “B” wave tends to be well below starting of the A

wave or below 61.8% of A wave.

Let’s jump to

the chart,

Wave (a)(b)(c) is a

correction of sub-waves as (i), (ii), (iii), (iv), (v) where as,

Wave (a) : five

waves

Wave (b) :

three waves

Wave (c) : five

waves complete the 5-3-5 structure.

You can see

wave (b) is well below the starting point of

wave (a).

b wave =

Fibonacci retracement 23.6% (a wave).

C wave is

truncated. It is completed in Y 1999 at $254.

Which is a sign

of the next wave will be powerful.

So

our first higher degree wave (2) from Y1979 to Y 1999 around 20 years &

Price $ 890 to $ 254.

Wave 2 has

shown a 71% price fall. We will consider it a sharp and deep 2nd wave.

Wave

(3): Y1999 to continuing

Have you

noticed the alternation between sub-waves 2 and 4?

Sub-wave 2 is

sharp and shallow whereas subwave 4 is complex and deep.

Subwave 3 is a normal

wave because subwave 3 < 161.8%(Sub-wave 1 )

So as per

Elliott's rules, any one of the three impulses should be extended. It may sub-wave

5th could be extended.

Sub-wave 5th :

Now you can

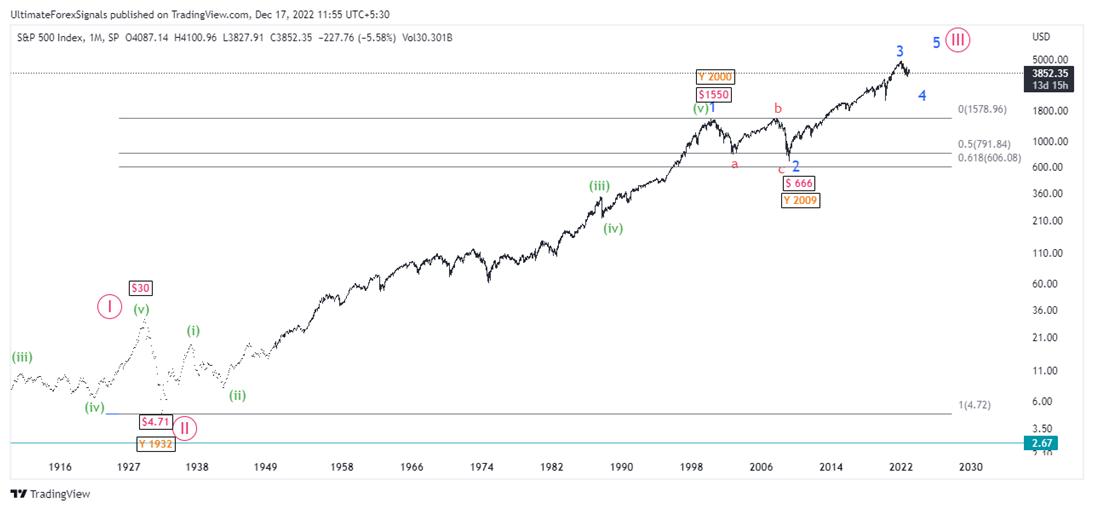

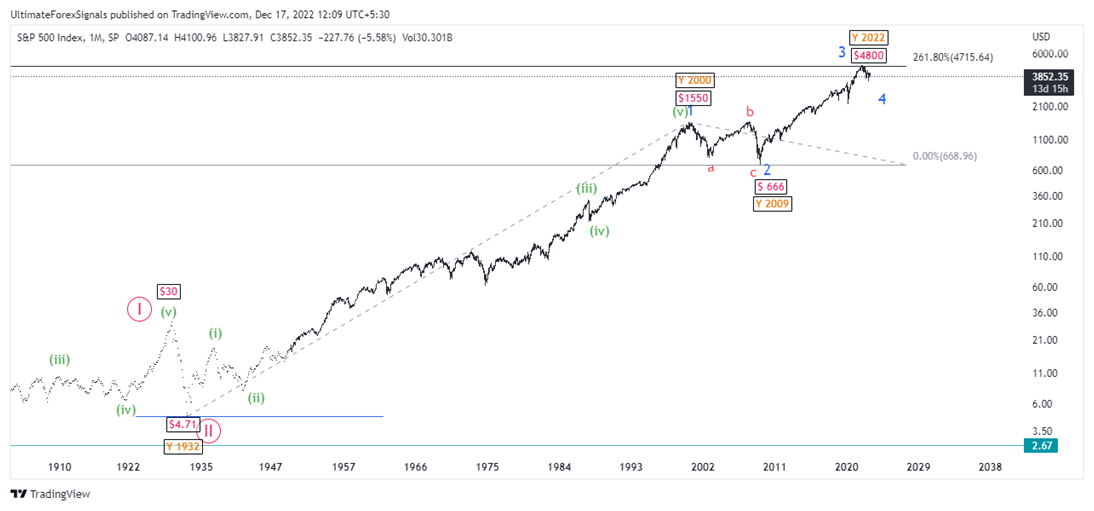

easily identify that we have completed III wave and complex wave IV . Wave III is nearly 261.8% (wave I)

Wave IV seems

completed "abc" correction. It may unfold a triangle or further any

complex pattern. It is very difficult to trade in 4th wave. When we are in 4th

wave then need extra care as it is complex and confusing. Many professionals

also avoid trading in 4th wave or reduce the lot size.

IV wave has abc

flat correction. Flat Correction pattern is ABC (3-3-5) as shown in the figure.

In this

pattern, A & B wave has three waves & C wave has five waves. C wave has

always five waves in any correction. In a flat pattern “B” wave tends to end

near starting of the “A” wave.

C wave is

completed at Low 1615. There is a possibility that the iv wave is completed or

may not. We should analyze the wave that started from the prior low 1615.

From 1615 either abc or new impulse begun. Till we have not confirmed.

If any triangle or complex pattern appear then we will count it as a IV wave. let's see which pattern going to unfold in coming days.

Forex Account Management Service :

Thank You

As

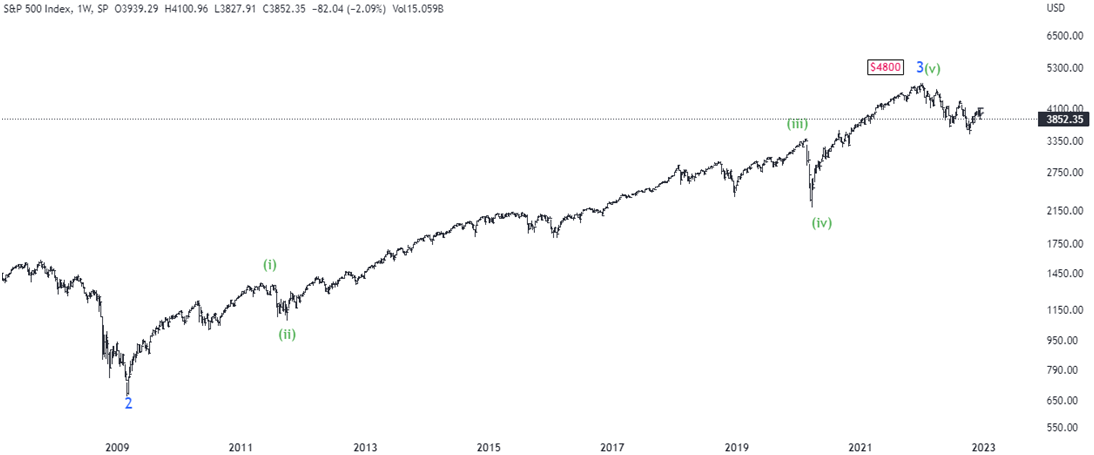

usual 3rd wave personality is easily identified on

the chart in any degree. Here extended Sub-wave 3 is exactly 261.8%

Fibonacci ratio of 1st sub-wave.

As

usual 3rd wave personality is easily identified on

the chart in any degree. Here extended Sub-wave 3 is exactly 261.8%

Fibonacci ratio of 1st sub-wave.  Inside

Sub-wave 3, Mini sub waves as mentioned in green color also dance to Elliott

tunes.Sub-wave 4: Y 2022 to Under Progress & Price $4800 to .... ???

Inside

Sub-wave 3, Mini sub waves as mentioned in green color also dance to Elliott

tunes.Sub-wave 4: Y 2022 to Under Progress & Price $4800 to .... ??? So

we have one level where the end of Sub-wave 4th correction is

$3230Let’s

double-check with the inside of the Sub-wave 4th pattern.

So

we have one level where the end of Sub-wave 4th correction is

$3230Let’s

double-check with the inside of the Sub-wave 4th pattern. WXY pattern is showing on chart.

WXY pattern is showing on chart.  So

we have one level where the end of Sub-wave 4th correction is

$3230Let’s

double-check with the inside of the Sub-wave 4th pattern.

So

we have one level where the end of Sub-wave 4th correction is

$3230Let’s

double-check with the inside of the Sub-wave 4th pattern. WXY pattern is showing on chart.

WXY pattern is showing on chart.